High risk and a leap in the dark – venture capital isn’t for everyone. How can anyone seeking to invest in it gain a better understanding of the risks and potential rewards?

For the investor who wants to add a bit of spice to their dealings, venture capital looks like the perfect solution. The risks are sufficiently vertiginous to satisfy any adrenaline junkie – and the returns can be astonishing. Take Google, the small technology firm that two venture capital firms (Kleiner Perkins Caulfield & Byers and Sequoia Capital) paid around $25m for a 20 per cent share of in 1999, and which now has a market capitalisation of more than $556bn.

But assessing the possible returns of venturing capital is not straightforward. The very concept of an “average” return is meaningless: while the occasional huge success can deliver stratospheric returns, most investments fail or succeed only to a modest extent.

So if the chances of striking it that lucky are low, easier access to data for returns on a broader range of venture capital investments could at least help identify factors that might highlight the talents of fund managers able to make wise investment choices. It would also enable a better understanding of the contribution venture capital makes to the wider economy.

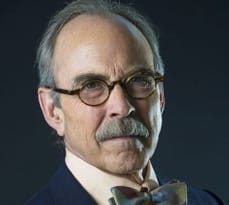

“Venture capital has been widely identified as a prime engine for funding innovation across a range of industry sectors, with profound economic consequences,” says Dr William H. Janeway, Visiting Lecturer in Economics at the University of Cambridge and Princeton University; and a Senior Advisor and Managing Director at Warburg Pincus.

“However, assessing the validity of such claims requires access to data and rigorous analysis of that data, so that it is possible to understand to what extent we should think of venture capital as a distinct asset class; and to measure the financial returns from investing in venture capital. There has been a great deal of academic research on the subject, but almost all is based on venture capital in the US, where there is more data available than in Britain or Europe.”

US researchers have been able to obtain some data in part because although most venture capital funds prefer not to disclose performance data, some in the US do so at the request of major institutional investors. Most available returns data for the UK and Europe has been self-released, so is unlikely to offer a warts-and-all picture of performance.

“Funds generally don’t disclose deal by deal outcomes,” says Benjamin Davis, investment director, Octopus Investments and Cambridge MBA alumnus. “I know of some companies that have failed and you go to the venture companies that backed them and what you’ll find is that on their website that investment will just discreetly disappear.

“I’ve looked at databases online that claim to capture venture capital and private equity deal data and I know some of the details I’ve seen there are not accurate. There are also some companies that try to gather anonymous, aggregated data on venture capital fund performance. But aggregated data tells you about an asset class; it doesn’t help an investor who wants to pick investments or investment teams.

“When funds have to go out and raise money, big institutional investors want to know how they’ve done in the past. So that information does exist. But those documents tend to be pretty confidential. They’re certainly not published online. You could force all fund managers to disclose fund or deal performance, but I don’t think that would be a good idea and I don’t know if it would work.”

Andrea Traversone, partner at Amadeus Capital Partners and Cambridge MBA alumnus, suggests the reason some funds have made public data about returns is because some investors demanded that data. “But VCs consider that information competitive advantage. So some of the best performing funds have turned away investors who would demand public disclosure of results.

“Unless you invest in every manager in the market you have to assume that if you make an allocation selection [of a manager] every year, some years you pick good ones and some years you pick bad ones,” Traversone says. “But really, to see what the real returns are, you need to be invested in venture capital for a long time. You have to say: ‘We are going to be in venture for decades’. Over 20 years you’ll find out if we got the returns, and if you were able to pick the best new managers. So to achieve strong returns on capital invested, above all you need patient capital and a significant amount of it.”