The potential impact of geopolitical and security shocks on the economy of the world’s largest cities has risen by 16% in the last year, according to the 2018 update of the Global Risk Index from the Centre for Risk Studies at Cambridge Judge Business School.

The 2018 update to the Global Risk Index from the Centre for Risk Studies is a collaboration with Lloyd’s of London and was launched on 6 June 2018 as the Lloyd’s City Risk Index. The index sees a uniform rise in GDP@Risk across all the 279 world cities that make up the index and more significant increases in risk for some urban centres.

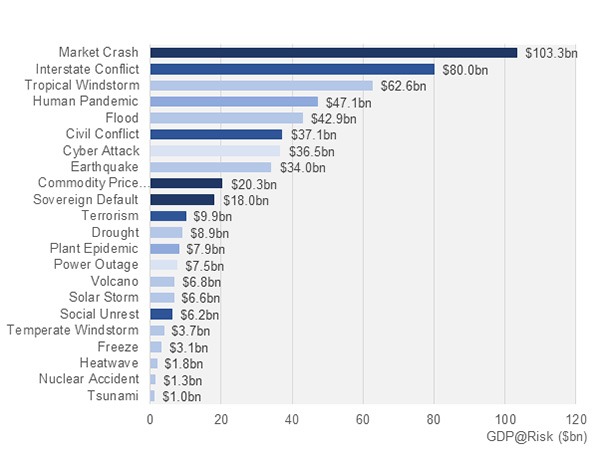

The Lloyd’s City Risk Index compiles the impacts of 22 types of threats into a single, annual measurement of economic loss. Interstate conflict, belonging to the geopolitical and security class of threats, is the only risk of the 22 to have increased systemically between 2017 and 2018.

The research by the Centre for Risk Studies is unique in making an annual quantification of the potential GDP impact of unpredictable shocks on the world’s most prominent cities. The 2018 results were published on 6 June 2018 by Lloyd’s. The Centre for Risk Studies’ analysis shows a 6.5% increase in GDP@Risk from 2017 to 2018. Of this, economic growth accounts for slightly more than half the increase while the balance results from changes in risk levels.

GDP@Risk is a calculation of each city’s economic output and its exposure to particular threats associated with its geography and type of economy offset by its resilience in recovering from them. The underlying analytics provide a methodology that governments, infrastructure providers, insurers and development organisations can use to quantify the economic value of improvements in city resilience.

Academic Director of the Centre for Risk Studies Professor Daniel Ralph, comments:

Shocks to the global economy are largely inevitable, resulting in real losses to the economy. The Global Risk Index demonstrates the value of investing in resilience. An economy’s ability to recover from a catastrophe is demonstrated by the speed and extent to which it reconstructs factories and homes, repairs damaged infrastructure, regains consumer and market confidence, and re-engages in business activities after an event.

The estimated potential impact of geopolitics and security catastrophes – civil and interstate conflict and social unrest – has risen significantly since 2015 when the Centre for Risk Studies compiled its first Global Risk Index. This increase reflects combined high levels of political turbulence in developed economies – challenging the contract between civil society and states, and evidenced by a rise in populism – and risks to global trade and global security. It is the only threat which has increased overall. The capacity for cyber attacks to cause severe economic damage is on the rise from the increasing number and severity of incidents, but capabilities to protect against them have also been increasing. The Centre has explored the current and quickly evolving cyber risk landscape in the Cyber Risk Outlook 2018, published earlier this year.

By size of potential impact, the top three classes of threats in the 2018 Index are:

- Natural catastrophes: GDP@Risk of $165bn

- Financial, economics and trade: GDP@Risk of $142bn

- Geopolitics and security: GDP@Risk $133bn

The complete ranking of the 22 threats in the Lloyd’s City Risk Index is shown below.