Traditional financial and operational performance top global risk management concerns over the next 12 months, while much-publicised issues such as environment, tax and diversity lag well behind.

Traditional benchmarks such as financial and operational performance top the concerns of senior risk managers of global corporations over a 12-month time horizon, while some highly publicised issues such as taxation, environment and diversity lag well behind, according to an enterprise risk management (ERM) report from the Centre for Risk Studies at Cambridge Judge Business School and the Institute of Risk Management (IRM).

A summary of the results from the Centre’s research track on corporate risk profiling is published today (15 November) in a report entitled Risk Management Perspectives of Global Corporations. The research was informed by subject matter specialist interviews; real-time polls from workshops and focus groups, and an in-depth online Enterprise Risk Management survey administered to the IRM and the Centre’s chief risk officer (CRO) and ERM communities.

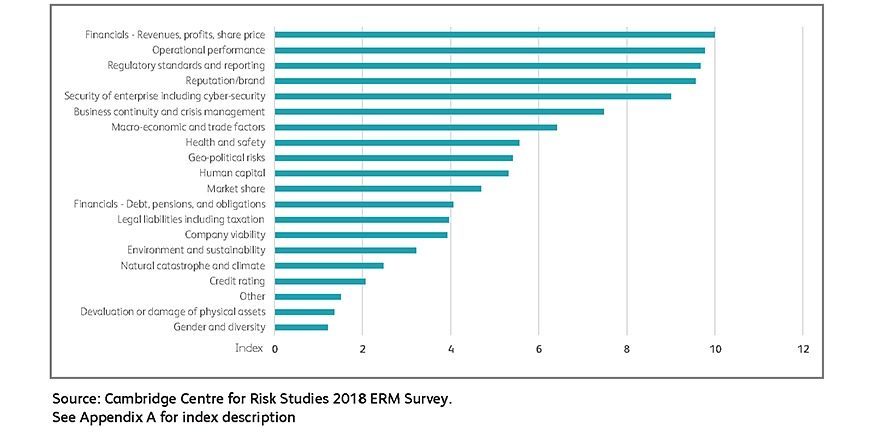

The research uses an index to score the risk managers’ views, rather than linear ranking, because it gives a more complete picture and creates a strong basis for future comparisons. The results show that financials (revenues, profits, share price), operational performance, reputation/brand, and regulatory standards and reporting were each scored by risk managers at or near the top index level between 9.0 and 10.0 (out of 10.0) in terms of importance or priority.

By contrast, some issues that have been very much in the news scored far lower in the report’s index: legal liabilities including taxation at 4.0, environment and sustainability at 3.2, natural catastrophe and climate at 2.5, and gender and diversity at 1.2.

The Centre’s Executive Director, Dr Michelle Tuveson, said:

“Global corporations feel forming an integrated view of their risks is challenging, as it must consider not just their physical presence but also the global nature of their exchanges, flows,stocks, and relationships under varying regulation and governance structures. The Centre for Risk Studies will be setting its research priorities to address these global risk management challenges.”

The IRM Chair, Socrates Coudounaris CFIRM, Risk Management Director at RGA International Reinsurance Company, commented:

“This research presents some challenges and also offers some guidance for the profession. There are some interesting lessons here about the varied nature of ERM functions in these global corporations, most obviously that there is as yet no generally accepted view on the mission, scope and ultimately, value, of ERM. However, at the same time there appears to be growing take-up of ERM-led approaches like encouraging healthy risk cultures, training and supply chain initiatives.”

More findings

The survey found that four of the top enterprise risks, such as financials and reputation, were strongly represented across most company sectors, but others were sector specific. For example, geopolitical risk was scored relatively low at 5.4 by survey respondents overall, but sectors such as energy, telecommunications, and materials scored it higher. Regulatory standards risk is the highest risk for the financials and information technology sectors, and the second highest for healthcare and telecommunications.

The report highlights the vulnerabilities of global corporations with renewed challenges to globalism coming from resurgent nationalism, protectionism, and reverses to international trade agreements.

The Centre for Risk Studies’ Academic Director, Professor Daniel Ralph, said:

Corporations must contend with both internal and external risks that threaten their business models. Their stakeholders are keenly aware of the many potential factors impacting corporate profitability and longevity, thus greater transparency in risk reporting will be expected in the future.

Other key points

Survey respondents reported little overlap between the activities of ERM teams and those involved in insurance purchasing and suggested there is considerable organisational distance between the two departments.

Of the survey respondents, 63 per cent reported using scenarios as part of their business risk analyses. Interview participants indicated that appropriate market tools are limited in their capacity to satisfy their requirements and address many of the top risks faced by a company.

Top risk mitigation strategies currently planned include increased training around the company’s critical operations, balancing staff and strengthening risk culture.

Improvements in culture, automation, transparency, modelling, and data analytics give reason for optimism. Participants in our research particularly highlighted the central theme of disruptive technology in the form of artificial intelligence (AI), robotics, and general increases in automation.